Rabu, 31 Oktober 2012

Singapore Residential Update (30-10-2012)

The good folks at Maybank-Kim Eng Research has published an update detailing the latest 3Q 2012 private homes statistics released by the URA. It also provided a rundown of the 6 rounds of property cooling measures that the Government have rolled out since September 2009 - a good summary for those who wish to know exactly what was implemented when.

Another interesting bit of information is the comparison of Additional Buyers' and Sellers' stamp duties that are currently being imposed in both Singapore and Hong Kong. It looks like our ABSD and SSD are getting some traction in other cities as well.

Click on the link below to read the full report:

http://www.scribd.com/doc/111659282/Singapore-Residential-Update-301012#fullscreen

Minggu, 28 Oktober 2012

3Q 2012 private home prices rose 0.6%

Singapore's private home prices in the third quarter rose 0.6% from the previous quarter.

This is the highest rate of increase this year compared to the 0.1% drop in the first quarter and the 0.4% increase in the second quarter.

It was also higher than the flash estimate of 0.5% released earlier this month.

Meanwhile, resale prices of Housing & Development Board (HDB) flats in Singapore hit a record high.

HDB's Resale Price Index (RPI) rose from 194 in the second quarter of this year to 197.9 in the third quarter.

This represents an increase of 2% over the previous quarter, the same as that of the flash estimate released on 1 October.

Growth for the first three quarters of this year is 3.9%.

This is lower than the annual RPI growth of 14.1% in 2010, and 10.7% last year.

"With private property prices still rising, it's no surprise that HDB prices will follow suit," said Mr Chris Koh, housing analyst and director of Chris International.

"We saw quite a number of people who wanted to buy a property, aspired to own one, but when they could not afford it anymore, they instead decided to buy in the HDB resale market. They chose particularly larger flats: five-room flats, executive flats, and this could have pushed percentage prices up."

The volume of resale transactions also fell for the first time in 12 months. Resale transactions also fell by about 6% from 7,011 cases in second quarter to 6,560 cases in the third.

The last fall in resale transactions was in the third quarter of last year when transactions fell from 6,581 in the second quarter, to 5,903 in the third.

In the rental market, subletting transactions rose by about 4%.

The number of cases increased from 6,891 in the second quarter to 7,142 cases in the third quarter.

Source: Channel News Asia

Jumat, 26 Oktober 2012

The Real Deals (25-10-2012)

It's all about HUDC in the latest issue of "The Real Deals" by Maybank-Kim Eng Research.

The report also highlighted Lakeview Estate, which should be a good candidate for redevelopment... technically that is.

It may surprise many that Lakeview is currently transacting at a discount of only 9.4% compared to the other private estates around the area. This is especially when Lakeview has no facilities other than a small playground. However, the estate is located near to (but far enough away from all the traffic noise) the main Upper Thomson Road and within walking distance to Marymount MRT station. There is also unconfirmed report that an access to the new Thomson Line will be built relatively close to the estate.

It may surprise many that Lakeview is currently transacting at a discount of only 9.4% compared to the other private estates around the area. This is especially when Lakeview has no facilities other than a small playground. However, the estate is located near to (but far enough away from all the traffic noise) the main Upper Thomson Road and within walking distance to Marymount MRT station. There is also unconfirmed report that an access to the new Thomson Line will be built relatively close to the estate. But what is most appealing about Lakeview (at least in our opinion) is its proximity to FOOD - there are options aplenty that are almost at your doorsteps so you will never ever go hungry. Families with school kids will also appreciate the various enrichment schools that are located along Upper Thomson Road. And for those who loves greenery and nature, Lakeview is situated right next to the Macritchie Reservoir and its forest trails. Matter of fact, one can access these directly from within the estate!

Given the supposed excellent location, why did the wife and I say that the en bloc potential of Lakeview is only "technically" good? We understand from very reliable sources that the bulk of the residents within the estate are elderly folks who have lived in Lakeview for tens of years. Many are even first owners! As such, it will be extremely challeneging to entice these group of people to vacate the estate. And one cannot underestimate the power of sentimental values especially with the older generation.

However, we feel that it may not be all bad if Lakeview does not go en bloc within this boom cycle (or whatever's left of this boom cycle, that is). There are no that many plots of vacant land left around the area that the Government can put out for sale. One such is a plot directly in front of Lakeview, which should be considered prime land (given its location). And if this plot is sold and a new condo project is built at this site, it should benefit residents of Lakeview as the values of their apartments will most definitely appreciate (remember Sky Habitat?). And once the supposed "nearby access" to the Thomson Line is confirmed, the site that Lakeview currently sits on will definitely be worth more than what it can fetch currently (think Thomson View Condo).

So we reckon Lakeview will probably be better off waiting a couple more years before they decide to do a collective sale... in our humble opinion, of course.

Click on below to read the Maybank-Kim Eng report:

http://www.scribd.com/doc/111187346/The-Real-Deals-25-10-2012#fullscreen

Rabu, 24 Oktober 2012

New project sales status: eCO & Sky Green

According to a Channel News Asia report, 515 units out of the 603 units released at eCO condominium project have been sold within a month. They were launched for sale on September 22.

The 748-unit development, located at Bedok South is a joint venture between Far East Organization, Frasers Centrepoint and Sekisui House.

The developers said all 240 two- and three-bedroom condominium units have been sold out.

Meanwhile, about half of the

In a joint statement released on Tuesday, the developers added that over 90% of the buyers were Singaporeans or Singapore Permanent Residents.

And majority of the buyers are living in the Bedok, Chai Chee, Marine Parade, and East Coast districts.

Prices for units at eCo start from $810,000 for a one-bedroom suite.

The project is estimated to be completed in 2017.

And in a separate report, Sky Green condominium, located along

About 80% of the 176 units available at the freehold development have been sold during its soft launch, according to the consortium behind the project.

The consortium comprises Heeton Holdings, KSH Holdings, TEE International and Zap Piling.

In a statement, the consortium said the units were sold at an average price of $1,502psf and the buyers were mainly Singaporeans.

The official launch of the development will take place next weekend.

Sky Green is expected to be completed in 2016.

Below are the project details for Sky Green for those who are interested:

Project: SKY GREEN

District: 13

Address: 570 MacPherson Road

Tenure: Freehold

Site Area: 66,928sqft

No. of Units: 176

Expected T.O.P: 2016

Unit Type Floor Area (sqft)

1-Bedroom 441 - 624

1+Study 474 - 721

2-Bedroom 614 - 990

3-Bedroom 1,152 - 1,163

4-Bedroom (dual key) 1,496

3-Bedroom (penthouse) 2,207 & 2,293

4-Bedroom (penthouse) 2,906

Senin, 22 Oktober 2012

Shoeboxes: Challenging times ahead..?

Sales of small private apartments, commonly known as shoebox units in Singapore, have taken a downward turn. Data compiled by analysts show that new sales fell about 57% in September from the previous month to 99 units.

The fall in the sale of shoebox units occured after the government announced that it will moderate the number of shoebox apartments entering the market.

Analysts said buyers are now taking a "wait-and-see" approach in response to the measures. This caused new sales of shoebox units to drop across the board last month.

Vicinities under the "Outside Central Region" category were hit the hardest, with sales falling some 80% to only 24 units sold in September. This is also the region where the new government regulations apply.

On September 4, the Urban Redevelopment Authority (URA) issued new guidelines that capped the total number of units that can be built on a site for non-landed private residential developments outside the Central Area. The new rules are to curb developers' enthusiasm to build shoebox units in 'suburban neighbourhoods' which are largely designated for families.

But analysts said the impact on buyers' appetites are only temporary. They said shoebox unit buyers are largely investors, and they may bounce back more quickly after each round of cooling measures introduced by the authorities.

Alan Cheong, director of research and consultancy at Savills, said: "Although we have one or two stories where people have decided to put off their purchases, we believe the market will revert to some sense of normalcy in a shorter period of time than it had been for the past five rounds of cooling measures.

"People have now got used to measures being thrown into the market, every year probably two or so."

Analysts added that recent launches in the last three months like Sky Green, Parc Centros and Skies Miltonia, still reflect "brisk" demand.

Sky Green, located in McPherson, sold all 68 studio units within a single day during its pre-launch last week. Parc Centros in Punggol and Skies Miltonia in Yishun, have sold out 88% and 75% of their units respectively.

They added that this trend is unlikely to change as long as investors hold enough cash to splash around.

Mohamed Ismail, CEO of PropNex, said: "They sell mainly because of two reasons. One being the fact that the quantum of such properties are relatively low, coupled with today's liquidity and low interest rate."

Moving forward however, analysts said the appeal of holding a shoebox unit as an investment is likely to wane.

Eugene Lim, key executive officer of the ERA Realty Network, said: "I think buyers are becoming more aware that there is actually a huge supply that is going to be completed in 2014, 2015. And that would mean this would put pressure on rental. It is this type of investments that is actually losing flavour."

About 11,000 shoebox units are expected to hit the market by 2015.

Source: Channel News Asia

Minggu, 21 Oktober 2012

Property spotlight: Toa Payoh

Located close to the Toa Payoh MRT station and within a 15-minute drive to Orchard Road Oleander Towers and Trellis Towers

When Oleander Towers Oleander Towers

Given the strong reception to Oleander Towers , property giant City Developments Ltd (CDL) launched Trellis Towers Trellis Towers is located just across the street from Oleander Towers

The launch of Trellis Towers

Completed in 2000, While Trellis Towers appeals to both investors and owner occupiers, interest is tilted towards investors because of its freehold tenure, says Ethan Ang, senior associate manager, C&H Properties, who specialises in marketing units in District 12. Oleander Towers Pei Chun Public School

The latest private condo in Toa Payoh is the 99-year leasehold Trevista, launched in August 2009 - a good 13 years after the first two were launched. The condo is made up of three 39-storey towers and has a total of 590 units. The development is located at the junction of Lorong 2 and Lorong 3 Toa Payoh, and is a little further from the Toa Payoh Hub and Toa Payoh MRT station compared with Oleander Towers and Trellis Towers

However, there was strong interest when Trevista was launched due to pent-up demand. At the preview, 410 of a total of 460 units were snapped up at prices averaging $898psf, which were then adjusted to $920psf as higher floor units were released.

"We were afraid that response at Trevista would be poor as the preview coincided with the Hungry Ghost Festival," recounts Ye, who was one of the marketing agents of Trevista when it was launched.

Singaporeans made up the majority of the buyers at Trevista. The project was developed by NTUC Choice Homes and completed last year. Resale transactions last month saw units changing hands at prices ranging from $1,227psf for a 1,141sqft second level unit to $1,631psf for a 463sqft studio unit on the sixth floor.

Given that it's the newest private condo in Toa Payoh, Trevista is said to have the most up-to-date facilities among the three, says C&H's Ang. The development contains three swimming pools, sauna, steam room, putting green and rock-climbing wall.

With only three private condos in the area, demand for units has so far outstripped supply, observes Knight Frank's Ye. She adds that most investors prefer smaller units as it is easier to rent out. Most of the enquiries from investors are for the two-bedroom apartments.

Toa Payoh these days sees a good mix of local and foreign investors. Most of the foreign investors come from China and Indonesia Trellis Towers Trellis Towers

Rental yields of private condos in Toa Payoh today are hovering around 4%, he estimates.

The area has been on investors' radar of late as the mature estate is located right at the city fringe, and is within a short distance of Orchard Road

Source: THEEDGE SINGAPORE

The wife and I had actually seen several 4-bedder units at Trevista after the development received its TOP. While we quite liked the apartment layout and finishing, we found the bedrooms too small for our liking. In addition, we found the bay windows within the master bathroom a tad too exposed especially for those facing opposite units (unless you enjoy being the exhibitionist). So window-blind makers should have a field day at Trevista.

Click on link below to read our review on Trevista:

http://sgproptalk.blogspot.sg/2010/01/trevista-review_2724.html

Jumat, 19 Oktober 2012

Q3 private home sales: Blame it on the Hungry Ghosts...again!

According to our de facto local English newspaper, the number of private home sales in Q3 2012 was 5,934. This is sharply down from the 10,780 transactions recorded in Q2.

And the lunar seventh month is (again) being blamed as the 'culprit'. It is said that superstitious home seekers avoid buying homes during the inauspicious lunar seventh month period, which cuts across half of August and September.

New home sales were down more than 50% - from 6,007 in Q2 to 2,659 in Q3.

However, some projects managed to buck the trend. The 154 units at One Dunsun Residences in Jalan Dunsun were almost sold out within two weeks despite launching towards the end of August. Kovan Regency in Kovan Road Upper Serangoon Crescent

Sales involving permanent residents (PRs) were less badly affected in the quarter than other buyer groups such as Singaporeans and foreigners. Transactions involving PRs fell about 37% compared with the previous quarter, while other groups registered declines of more than 45%.

Sales of new executive condominiums (EC) have also slowed in Q3, possibly because of the increased number of Build-to-Order flats and EC launches.

About 27,000 flats are expected to be launched this year.

On the resale side of things, 2,850 units were transacted in Q3 versus 4,062 units in Q2. For sub-sale, 425 units were transacted in Q3 down from 711 in Q2.

Rabu, 17 Oktober 2012

It's my balcony and I'll build if i want to..? Think again!

The following article by Seah Sin Tong appeared in the "voices" page of the TODAY paper today:

Buying a condo or a penthouse with 'open balcony'?

Potential buyers should be aware of the issues involved when buying condominium units and penthouses with an open balcony design, to avoid a situation where what they see in the showroom may not be what they get.I moved last year into a new penthouse near Upper Bukit Timah Road

No awning can be built over the balconies, as the developer has used up the allotted Gross Floor Area (GFA). Adding new awnings mean additional GFA, for which levies borne by the owners must be paid to the Urban Redevelopment Authority.

Another issue is developers' use of a trellis for balconies. Due to GFA limit, our trellis was not covered with material such as polycarbonate, causing water to spill in when it rains.

After appealing to the URA, it kindly agreed to give an exemption for the trellis to be covered with no GFA implication.

One would expect the developer to help cover the trellis, but it did not, citing that the condo was built according to the plan submitted to the authority and that there was thus no design defect.

Potential buyers should be prepared to ask questions and do research on the developer's track record before taking the plunge, particularly if an open balcony design is used, to avoid additional bills which could crop up after they take over the units.

++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++++

The wife and I reckon that unless the developer has deliberately misrepresented themselves by displaying the awning or "covered" trellis in their showflats or their marketing representatives have indicated that these can be installed during their sales pitch, when in fact such structures are actually not allowed, it is primarily a case of caveat emptor.

The same goes with those "lofts" that are supposedly allowed for apartments with "double-volume" ceiling - we have been to new projects in the past whereby such loft was actually displayed in the showflat and we were told that owners can freely erect these in their units. But in actual fact, the erection of such loft are subjected to approvals from the condo management and Building Construction Authority (BCA).

So when in doubt, ASK!

Senin, 15 Oktober 2012

Too many buyers too few homes? Not for long...

26,800 Housing and Development Board (HDB) flats and 22,400 non-landed private housing units are projected to be completed in 2014.

The numbers are significantly higher than those projected for this year -- 11,300 HDB flats and 12,500 non-landed private housing units are expected to be completed in 2012.

The National Development Ministry revealed these figures in a written response to questions posed by Pasir Ris-Punggol Group Representation Constitutency (GRC) Member of Parliament (MP) Gan Thiam Poh in Parliament on Monday.

Speaking in Parliament, National Development Minister Khaw Boon Wan said there is a significant supply of housing - both public and private - that will come onto the market over the next two years.

He said HDB has ramped up its Build-to-Order (BTO) supply significantly, and will keep up the pace of new flat supply into 2013.

He said this is to provide more options to suit individual housing needs and budgets.

Holland-Bukit Timah GRC MP Liang Eng Hwa had also asked if there are enough flats to meet unanticipated demand, such as those from singles.

He asked: "We may not always get the demand and supply right, so is HDB building some surplus to meet those unanticipated demand?"

Mr Khaw said the ministry is looking into the matter.

He answered: "We're still mulling over it. (It is) very hard to put a figure on how much should we cater for singles."

Mr Khaw added that strong demand for residential property in Singapore is likely to persist as interest rates stay low.

While residential property prices may be stabilising, Mr Khaw said, Singapore is not yet "out of the woods".

The Resale Price Index has seen an uptick in the third quarter this year, with a two per cent growth from the second quarter of 2012 based on flash estimates.

"With the recent announcements of further monetary expansion in both US and the eurozone, the current low interest rate environment is likely to persist," said Mr Khaw.

"This will continue to contribute to the strong demand for residential property, which could cause prices to rise beyond sustainable levels."

He added the recently-announced new curbs on loan tenures are to encourage greater financial prudence among property purchasers in both the public and private housing markets.

The new curb is also a calibrated step to prevent excessive speculation.

According to analysts, the increased number of HDB flats to be completed in 2014 does not come as a surprise, as the government has been ramping up HDB flat supply in the past years.

Analysts say most of the flats should have been taken up by then, as typically about 70 per cent of units have been booked. Remaining units are also sold under the Sales of Balance Flats programme.

"Also, the BTO is a scalable programme; the government can always scale down the number of units that's being launched once the needs of the home buyers have been met," added Mr Eugene Lim, key executive officer of ERA Realty.

The higher number of HDB units is not expected to have a significant impact on the resale market, if the flats are sold after the minimum occupation of five years in 2019.

Mr Lim said: "It is a bit far ahead to predict the impact on the resale market but I would suspect not all these flats' owners will be selling their flats at the same time. Therefore the impact on the resale market prices will not be significant."

But it could be a different story for the private housing market.

According to Mr Lim, an oversupply is possible, and investors renting out units could be affected.

"We are already reducing foreign manpower and if this were to continue in the years to come, then we'll find that in the year 2014, there may not be as much foreign manpower to take up the rental units," said Mr Lim.

"And when you have so many new units being completed in the market, then we might have a slight oversupply situation and that would lead to reduced rentals."

The National Development Ministry says about 39,600 units of private homes from projects in the pipeline remain unsold as of June this year.

Source: Channel News Asia

It looks like the magic number is indeed 2014!

September private home sales up 84%!

Demand for new private homes jumped by 84% in September from August, led mainly by a strong rebound in the mass market segment.

According to the Urban Redevelopment Authority (URA), 2,621 new private homes, excluding executive condominiums, were sold in September.

The number is the second highest since 2,772 units were sold in July 2009.

Analysts see this as a strong rebound, particularly when sales in August were 27% lower than in July.

The rebound in September is in sharp contrast to the slow month in August when some home buyers stayed away during the Hungry Ghost Festival, which typically sees fewer property project launches.

Analysts said that such stellar performance may not be repeated in the last quarter of 2012.

Christina Sim, director (residential) at Singapore Cushman & Wakefield, said: "October should not see so many units. I believe it should return back to the normal, maybe to 1,500, to 1,800. November should be even less, and December would be extremely quiet."

Analysts said the latest cooling measure on home loans introduced early this month may also dampen sales figures. The other cooling measures include Additional Buyer Stamp Duty and the Seller's Stamp duty.

Some analysts have said that another round of cooling measures may also be on the cards.

Eric Tan, CEO of GSK Global, said: "Basically, I think the government is looking at liquidity - how the US is going to affect us. Also the increase in prices. So long as prices increase by one to two per cent in the next three-quarters, I believe the government is going to step in and cool the market again with more measures.

"This time round, if the market is going to fall, it is going to be a few times harder than in 1997. It is going to fall very, very hard, because the prices have gone up too much."

In the meantime, the supply of new homes has been increased to curb prices.

Two sites in Tampines were launched for tender under the government land sales programme. Besides these two sites that can yield up to an estimated 1,240 private units, another three sites -- for private homes and executive condos -- were also put up for tender. In all, these five sites can yield some 2,880 units.

Out of the five sites, only one site next to Sky Habitat is located in the city fringes or Rest of Central Region.

Figures showed that 2,062 new units sold in September were located in the suburbs or outside central region. This was more than double the 835 units moved in August.

The number of units located in the core central region climbed 15% from 218 units in August to 251 units in September.

Demand for new homes in the city fringe, however, bucked the trend - 208 units changed hands in September compared to 368 units in August.

Source: Channel News Asia

Sabtu, 13 Oktober 2012

Of capital gain tax and COV...

There was a letter from a certain Mr Zhuang Li-Hao that was published in the Straits Times forum page yesterday. Mr Zhuang felt that existing policies curb transaction volumes, but are by themselves inflationary. This is why prices continue to rise despite the various rounds of cooling measures.

He suggested two ways to modify current housing policies to create more stable housing prices and demand:

1. Replace Additional Buyer's Stamp Duty (ABSD) and Seller's Stamp Duty (SSD) with a capital gain tax

Mr Zhuang feels that both ABSD and SSD deter speculators, but directly increase the costs of ownership and transaction. And in a rising housing market, buyers and sellers will hold on to their positions. Sellers in particular, will build the ABSD and SDD into selling prices. As such, the number of transactions drop as prices increase.

He proposed to replace ABSD and SSD with a capital gain tax of 100%, 75%, 50% and 25% respectively in the first four years. In this way, the cost of ownership remains the same. Speculators have no incentive to buy and sell since all profits are taxed, especially in the first year, while genuine buyers and sellers are not punished.

2. Replace the Cash Over Valuation (COV) with Cash Over HDB Price

The COV component for resale flats creates a volatile and unstable system as valuation is based on the last transaction. In a rising market, every transaction increases valuation by the COV amount. Mr Zhuang proposed to replace COV with cash over HDB price. The prices of flats that HDB sold to first owners are fixed. The new component will force buyers to fund the difference between the selling and original prices with cash or CPF savings, and not with loans. He felt that thus will immediately create a stable pricing system.

A couple of thoughts came to our minds after reading the article:

- The wife and I have bought and sold 3 different properties over the course of 6 years, prior to our current home. We only owned those properties for less than 2 years each BUT we were staying in all the property concerned during the period of ownership. So does that still make us a speculator as opposed to genuine buyer and seller?

- While we understand the (real) reason why our Government will prefer alternative form of measures to cool the market rather than imposing capital gain tax, is the later really a more effective measure to stabilize housing prices and demand? The proposal by Mr Zhuang is likely to kill the sub-sale market instantly and reduce activities in the resale market somewhat. But if it is indeed true that the current high prices are due to exceptional strong demand for mass-market homes from genuine upgraders with primarily HDB addresses, even the change-over to a capital gain tax will have a muted effect on buying interests.

- And speaking of COV and escalating HDB resale prices, the wife and I (wife in particular) believe that the whole purpose of subsidized public housing is to ensure that every Singaporean has a roof over their heads and to fulfill their aspirations of home ownership. It is not meant to be a mechanism for people to make (indecent) amount of money out of. We feel that one of the primary reason why prices for mass-market homes are being "chased up" to the current levels is because of the money that potential HDB upgraders can make out of selling their flats these days. As such, the Cash Over HDB Price proposal is an interesting proposition. The public housing market should be "controlled" for both the new and resale markets. You can have all the free market mechanism you want in the private housing sector.

The above are just our humble opinions as always. We love to hear what you think.

Have a great week ahead!

Jumat, 12 Oktober 2012

More difficult for HDB upgraders to achieve their condo dreams?

Contrary to the popular belief that prices have stabilized in recent quarters, the cost of owing a new condo is still high, says Alan Cheong, director of research and consultancy at Savills Singapore

Units in sought-after locations near MRT stations such as Kovan and Serangoon are being transacted at $1,300 to $1,600psf. In addition, new suburban condos near MRT stations are being launched at more than $1,000psf. "Increasing HDB prices have helped raise the support levels for the private market," he adds.

With interest rates remaining low, and more capital flowing in as a result of QE3," we are cautiously optimistic that property prices may be poised to trend higher, possibly rising by at least 10% by end of 2013", notes Cheong. "Astute international buyers are expected to seek value buys in the luxury market."

A 10% increase in residential prices by next year would be no surprise, judging from the winning bid prices achieved at government land sales, which have risen 27% in the last six months, estimates Cheong. "Developers will have to pass the higher cost back to consumers."

He sees "the influx of such hot money [precipitating] into the formation of property bubbles", which could also mean the implementation of more government cooling measures. He questions the effectiveness of the property curbs in limiting speculative purchases. "The property curbs may not have doused the strong buying sentiment nor subdued the rising prices," he says.

In a report dated Sep 25, Morgan Stanley Research expressed caution in the residential market. With interest in new launches rebounding after a seasonally slow August/September, and the post-QE3 announcement on Sep 13, there is increased risk of further policy action, says Sean Gardiner, managing director of Morgan Stanley Research, and analyst Wilson Ng. However, developers are facing higher costs and a margin squeeze, notes Morgan Stanley. Thus, the analysts are expecting prices to see a 13% decline through 2013.

Source: THEEDGE SINGAPORE

Click on link below for some interesting data related to this article:

Kamis, 11 Oktober 2012

Pasir Ris, Punggol. Next stop...Hillview?

Sales of new private homes have been brisk in the past year for projects in neighbourhoods like Pasir Ris and Punggol.

And some industry players said the Hillview area, located in the western part of Singapore, could be the next up-and-coming spot with more projects lined up.

The Hillier - a mixed development project at Hillview Avenue - is one of several new offerings in the area.

It has seen strong take-up, with 96% of the total number of units sold.

DWG's senior manager for training, research and consultancy, Lee Sze Teck, said: "It is a private residential enclave, so it will attract quite a fair bit of people who want the peace and tranquility to stay there. Of course, the traffic network there is not so built-up yet but with the upcoming Downtown MRT line, it will improve the network in the area."

Analysts predict that Hillview, along with nearby Cashew, Chestnut and Diary Farm areas, could garner more interest.

It is estimated that there would be over 2,000 new units in these areas in the next five years.

These projects include The Hillier (528 units), Eco Sanctuary (483 units), Tree House (429 units), Foresque Residences (496 units) and an upcoming condominium by Kingsford Development which could yield up to 500 units.

Market watchers said prices of new projects have climbed and could encourage developers to put in more optimistic land bids.

Knight Frank's head of consultancy and research, Png Poh Soon, said: "For example Foresque, when it was launched, it was about $1,200psf and that set the new benchmark. When The Hillier came in, it is now on average transacting between $1,500psf and $1,600psf."

Mr Png added: "When the market is being tested at this level and buyers are coming in, it seems to be able to support a certain selling price and thereafter, if you translate back to land bids, developers are more optimistic in their tendering in terms of whether the market is able to support at that range."

Mr Png said prices of some units have also appreciated, looking at sub-sale transactions. For instance, a unit at Tree House at Chestnut Avenue was launched at $835psf, but it was sold at $945psf in the sub-sale market. Sub-sale refers to the resale of uncompleted units and it is a key gauge of speculative activity.

Another area with bright prospects in the long term is Woodlands, located in the northern part of Singapore. Property analysts said this optimism is driven by two key factors - better connectivity and increasing commercial activities in the area.

The existing Woodlands MRT station will link up with the upcoming Thomson Line which will be fully completed in 2021.

Colliers International's director of research and advisory, Chia Siew Chuin, said: "We've also seen an increase in activities across the Causeway by Singaporeans, whether it is social activities or buying of properties across the Causeway. Woodlands is actually primed to be the main conduit for this channel of commercial and social activities."

Colliers International said the median price of non-landed private homes in Woodlands rose by 6.9%in the third quarter this year from the first quarter of 2011.

This is slightly lower than the 7.2% increase in overall median price of similar homes in the mass market segment over the same period.

And there should be more upside ahead when the potential of the area is realised.

Colliers International also earmarked Jurong East as a property hot spot in the next 10 to 15 years, as the area is slated to be a new commercial hub under the Urban Redevelopment Authority's Masterplan 2008.

Ms Chia said median prices of non-landed private homes in Jurong East rose 7.7% in Q3 2012 from Q1 2011.

Source: Channel News Asia

Rabu, 10 Oktober 2012

Enbloc news: Katong Park Towers

The development has 118 units and sits on 99-year leasehold land with a site area of about 13,077sqm. It could soon be sold for between $330 million and $340 million, or $1,145to $1,178psf ppr, including 10% of balcony space, said sole marketing agent DTZ.

The firm said the site can be redeveloped into a 24-storey condo with a maximum gross floor area of about 27,462sqm. And assuming an average apartment size of about 735sqft, the developer will be able to build about 392 units.

The property is "nestled within a serene and tranquil neighbourhood along Arthur Road

The property is near to amenities such as Parkway Parade, 112 Katong, East Coast Park Eton International Pre-School , Dunman High School , Canadian International School and Chatsworth International School

As such, the new development should appeal to both locals and foreigners.

As such, the new development should appeal to both locals and foreigners.

The tender closes on Nov 6.

Source: One of our local "non-free" newspaper

The wife and I have actually contemplated about buying a unit at Katong Park Towers

Selasa, 09 Oktober 2012

For those seeking rental income...

Rentals for private homes are expected to ease in the next 12 months, especially those in the luxury segment.

Experts said current rentals for private homes are just 1% off the peak recorded in the second quarter of 2008.

It used to take about a month to secure a tenant for private homes in the rental market last year.

Now, it takes about three to four months, according to analysts.

While rentals have edged up slightly in recent years, the vacancy rate too has gone up, especially for high-end units.

Ku Swee Yong, CEO of International Property Advisor, said: "In the luxury segment, if we were to include Sentosa Cove, then the vacancies are as high as 9 to 10%, whereas islandwide, we are still seeing...average vacancies of about 5.5 to 6%."

On average, it would cost about $5 to $8psf per month to rent a luxury home.

Some analysts said rentals for high-end units could come under pressure over the next 12 months, in view of the uncertain economic outlook and the additional supply of new units hitting the market. They said average rentals could dip by 3 to 5% in 2013.

Donald Han, special advisor at HSR, said: "Corporates are looking at reducing its cost, and part of the cost that will be reduced is expatriate housing allowances, so the first top-tier of that market being the luxury end of the residential apartments, some good class bungalow projects have seen a drop in terms of actual transacted rents."

Mr Han said that for instance, the rent for a 15,000sqft good class bungalow which is about 10 years old went for $28,000 to $38,000 per month last year, but rentals have dropped by 3% since.

Meanwhile, the rental prospect of mass market units remained fairly stable.

Some analysts said the rents for such homes could see a 1 to 2% upside in the year ahead.

Industry players said average rental for mass market homes currently ranges between $3 and $4.50psf per month.

But there will be stiffer competition for areas like Hougang, Pasir Ris, Sengkang and Punggol, where many new housing projects are lined up.

"My own estimation is that these areas would account for 50,000 new homes by 2015, and that is a significant addition to that stretch," said Mr Ku.

Nicholas Mak, executive director of SLP International Property Consultants, said: "Whenever a new project is to be completed in a certain area, the owners who are planning to rent it out are probably being approached by many agents, and tenants typically would prefer newer apartments with newer amenities. So we will definitely see some tenants being drawn away from the older developments to newer ones."

With some key events coming up, industry players expect overall rental rates to stay soft in the coming months.

The events include the US presidential elections in November and the ongoing efforts to fix the eurozone debt crisis which is now into its third year.

Source: Channel News Asia

With the onslaught of new private apartments coming onstream over the next 2 - 3 years, one better pray that the economy improves quickly and with it, the expat packages as well!

Senin, 08 Oktober 2012

Maybank Kim Eng on latest property cooling measures

Here is what Maybank Kim Eng Research thinks about Round 6 of the property cooling measure.

http://www.scribd.com/doc/109444574/Kim-Eng-Research-09-10-2012

Minggu, 07 Oktober 2012

Business as usual despite new housing loan restrictions!

According to reports, more than 300 units have been sold at Allgreen Properties' 920-unit Riversails, with at least 20 homes sold over the weekend. Prices of the larger units average slightly over $800psf while the one-bedroom units average $1,000psf.

The larger units (three-bedrooms and above) at the 99-year project have been doing well, with quite a few sold to upgraders. Three out of the five stacks of one-bedroom units launched have been sold.

Over at Sky Miltonia, 67% of units at this 420-unit have found buyers. The developer is offering an 18% discount and throwing in the option for buyers of certain units to upgrade their flooring to marble.

The 748-unit eCO in Bedok South has thrown in an additional 2% furniture voucher in addition to an array of discounts offered.

According to our central bank, the average tenure for new residental property loans jumped from 25 years to 29 over the last three years. Over 45% of the new home loans have tenures exceeding 30 years.

Lower initial monthly repayments from long loan tenures and low interest rates may cause borrowers to overestimate their loan servicing ability, says MAS (The Monestary Authority of Singapore).

Our blog posting on the new housing loan restrictions have generated a fair amount of discussion between our readers (which the wife and I are extremely pleased, as it is another small indication that people actually read our blog). A few have expressed the opinion that the new restrictions will have little to no impact on demand. But if it is indeed true that over 45% of the current new home loans are more than 30 years, we believe that the "penalty" imposed on loan tenures that exceed 30 years will have a significant effect on demand going forward. Already units at new launches are not flying off the shelves as they used to be just a couple of months ago.

While we cannot claim to be a representative sample, the new restrictions have effectively put us out of the market for a second property - the longest tenure that the wife and I can qualify for a new housing loan is about 20 years, else we be hit with the new LTV ratio of 40% of the property value should we decide to extend the loan period beyond the retirement age of 65 years.

And we are pretty sure that we are not alone in this predicament.

Having said that, the fear of potential (especially younger, first-time) buyers being lulled into complacency by the combination of lower initial monthly repayment with a longer loan tenure and low interest rates are very real indeed. We were once guilty of such back in our early days of property venture, and it took a bout of rising interest rates to jolt us back to reality...

Property spotlight: Luxury segment stirring again

The luxury segment of the market is starting to see a return of investor interest. Mr Seah, an avid Singaporean property investor and the owner of a freight forwarding business, recently signed the option to purchase a four-bedroom unit on the 62nd level of the 66-storey Marina Bay Suites. He paid close to $6.7 million ($3,258psf) for the 2,056sqft unit in mid-September. "

The luxury segment of the market is starting to see a return of investor interest. Mr Seah, an avid Singaporean property investor and the owner of a freight forwarding business, recently signed the option to purchase a four-bedroom unit on the 62nd level of the 66-storey Marina Bay Suites. He paid close to $6.7 million ($3,258psf) for the 2,056sqft unit in mid-September. "As the 22-unit luxury condominium is projected to be completed sometime next year, he's looking for an interior designer to help him with the furnishing. Seah intends to move into the apartment when it's completed. He currently lives in a bungalow in the Siglap area.

There are more Singaporeans shopping in the luxury condo market right now, unlike in the past, when this top end of the residential market was dominated by overseas buyers. At the freehold 330-unit Ardmore Park, developed by Wheelock Properties, a 2,885sqft, four-bedroom apartment on the 10th floor of one of the three towers was sold for $9.05 million ($3,137psf) on Sep 10.

The last time the unit was sold was at the previous peak in mid-2007, when it went for $7.95 million ($2,756psf). It had changed hands just three months earlier, in March 2007, for $6.3 million ($2,184psf). Prior to that, it was sold in a sub-sale in July 1998, during the Asian financial crisis, for $4.1 million ($1,421psf). This was 19.3% below the buyer's original purchase price of $5.08 million ($1,761psf) in August 1996, at the peak of the mid-1990s property boom.

The last time the unit was sold was at the previous peak in mid-2007, when it went for $7.95 million ($2,756psf). It had changed hands just three months earlier, in March 2007, for $6.3 million ($2,184psf). Prior to that, it was sold in a sub-sale in July 1998, during the Asian financial crisis, for $4.1 million ($1,421psf). This was 19.3% below the buyer's original purchase price of $5.08 million ($1,761psf) in August 1996, at the peak of the mid-1990s property boom.The latest transaction price for the unit is the second-highest psf price achieved at Ardmore Park Ardmore Park Ardmore Park

The freehold Nassim Park Residences saw its first sub-sale this year, according to caveats lodged with URA Realis. The 100-unit luxury condo is fully sold and obtained its temporary occupation permit just last year. The project is developed jointly by UOL Group, Kheng Leong and Orix Corp. The unit that changed hands in the sub-sale was a 3,466sqft, four-bedroom apartment on the fourth floor that was transacted at $11.3 million ($3,260psf). The seller had purchased the unit directly from the developer in July 2008 for $10.16 million ($2,932psf), thus seeing a capital appreciation of 11.2% in four years. As Nissam Park Residences is only a year old, transaction prices are usually pegged to the market rate for new units, says Wong. There are very few secondary transactions in Nassim Park Residences as most of the buyers had purchased units for their own use, she adds.

Most buyers in the luxury segment today tend to be owner-occupied rather than investors, says a property consultant who declines to be named. This is because rental yields at the luxury segment tend to be relatively low, with gross rental yields in prime district 10 generally hovering at 2% to 2.5% gross, he estimates.

Word on the street is that Wheelock Properties held a VIP preview of the freehold Ardmore Ardmore 3 is a departure from Wheelock's well-honed formula for luxury apartments, as seen in Ardmore Park

In Ardmore

Most buyers who purchase units in the luxury segment today are also hoping for future capital gain, says a property agent in the luxury market. "With the strong Singapore

Source: THEEDGE SINGAPORE

.

Sabtu, 06 Oktober 2012

Watertown and The Hillier more than 95% sold!

The Watertown integrated development in Punggol is almost 97% sold, according to developer Far East Organization yesterday.

The remaining 34 units are mainly those with three or four bedrooms, and range in size from 1,173sqft to 1,550sqft.

These are amongst the "best-facing units within the development overlooking the Punggol Waterway", said Far East, which is co-developing the project with Sekisui House.

Watertown is Punggol's first project with both a retail and residential component. Construction of the retail component has just started and is scheduled for completion by 2015. The residential component is expected to be completed by 2017.

Separately, Far East said it has sold 96% of the units at another of its mixed-use projects, The Hillier at Hillview Avenue.

The 528-unit development was launched in January and 21 units are left.

Click on links below to read our review of Watertown:

http://sgproptalk.blogspot.sg/2012/02/watertown-review-part-1.html

http://sgproptalk.blogspot.sg/2012/02/watertown-review-part-2.html

Click on link below to read our previous post on The Hillier:

http://sgproptalk.blogspot.sg/2012/01/new-project-sales-update-225-units-sold.html

Jumat, 05 Oktober 2012

End of the road for them 50-year housing loan...

The Monetary Authority of Singapore (MAS) will restrict the tenure of loans granted by financial institutions for the purchase of residential properties, effective from 6 October.

MAS' move is part of the government's broader aim of avoiding a price bubble and fostering long-term stability in the property market.

The maximum tenure of all new residential property loans will be capped at 35 years.

In addition, loans exceeding 30 years' tenure will face significantly tighter loan-to-value (LTV) limits. (* We understand from tonight's news report that the new ratio will be 60% for first property and 40% for all subsequent proporties *)

The new rules will apply to both private properties and HDB flats.

"Over the last three years, the average tenure for new residential property loans has increased from 25 to 29 years. More than 45% of new residential property loans granted by financial institutions have tenures exceeding 30 years," MAS said.

"The new rules aim to curb continued upward pressure on residential property prices, driven by low interest rates and rapid credit growth," the central bank added.

Previous rounds of measures have had a moderating effect on residential property prices. There is also significant supply of housing that will come onto the market over the next two years.

However, prices in both the HDB resale market and private residential property have continued to rise in Q2 and Q3 of 2012.

Private home prices rose 0.5% in the third quarter from the April-June quarter, when prices increased by 0.4%, while HDB resale prices gained 2.0% quarter-on-quarter following an increase of 1.3% in April-June.

Source: Channel News Asia

Kamis, 04 Oktober 2012

New project sales status: Riversails, Kovan Regency

A tad late in sharing but below is as per news report on Tuesday:

Riversails

Allgreen Properties has sold slightly over 200 units at Riversails at Upper Serangoon View since Friday. The average price is $827psf. The 99-year project has 920 units.

Kovan Regency

Hoi Hup moved close to 370 units or 94% of its 393-unit Kovan Regency over the weekend. The average price of the 99-year project at Simon Road/Kovan Rise is $1,250psf.

Project Info: Riversails

Here are more information on Riversails that the wife and I have managed to gather from the internet:

Project Name: Riversails

Description: 12 Blocks of 18 storey condominium with basement carpark

Developer: Benefit Investments Pte Ltd (Subsidiary company of Allgreen Properties Ltd)

Tenure: 99-year Leasehold

Location:2 Upper Serangoon Crescent

District: District 19

Land Size: 265,015sqft

Total Units: 920 units

Expected TOP: 30th September 2017

Carpark Lots: 930 Lots (inclusive of 10 handicap lot)

Description: 12 Blocks of 18 storey condominium with basement carpark

Developer: Benefit Investments Pte Ltd (Subsidiary company of Allgreen Properties Ltd)

Tenure: 99-year Leasehold

Location:

District: District 19

Land Size: 265,015sqft

Total Units: 920 units

Expected TOP: 30th September 2017

Carpark Lots: 930 Lots (inclusive of 10 handicap lot)

.

New project spotlight: Riversails

Allgreen Properties has typically been focused on the prime districts, with projects such as the newly completed 235-unit Viva on Thomson Road

While most developers of suburban projects are focusing on creating compact units targeted at HDB upgrader market, Allgreen has decided to provide quality finishings and spacious layouts more akin to high-end condos in prime districts, says Yong Voon Chen, director of sales and marketing at Allgreen.

The developer has engaged Patty Mak of Suying Design to plan the space layout as well as the interiors of the apartments. Among property developers, Mak has been the preferred name for high-end projects, having taken on projects such as Allgreen's Viva and Skysuites@Anson, Lippo Group's Centennia Suites, OUE's Twin Peaks at Leonie Hill and Sing Holdings' The Laurels at Cairnhill.

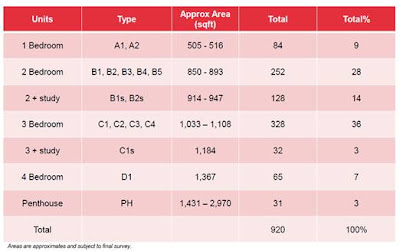

At Riversails, there are only 84 one-bedroom units of 505 to 516sqft. The one-bedroom units will have timber flooring and a wall partition that can slide to close off the master bedroom from the living and dining area. Unlike most projects, even the one-bedroom unit will be provided with a utility or storage room. The "transformer kitchen" is designed so that it can be hidden from view when not in used, which is similar to what is being offered at Allgreen's Skysuites@Anson.

An integrated refrigerator and oven will be provided for the one-bedroom units, which are designed such that the living area can fit a three-seater sofa, says Yong. "The household shelter for one-bedroom units is located in the stairwell, so there is a lot of usable space even in a 505sqft apartment."

For units other than the one-bedroom apartment, all bedrooms can fit a queen-sized bed, adds Yong. "We try to provide space and proper bedroom sizes." Every unit has marble flooring and a balcony adjoining the living room, spacious enough to fit a table and chairs, and also to allow natural light into the rest of the apartment. Bathrooms are provided with storage cabinets, under-counter lights and Duravit sanitary ware.

The majority of the units in the project are two-bedroom units of 850 to 893sqft, 2-bedroom + Study units of 914 to 947sqft and three-bedroom units of 1,033 to 1,108sqft. There are also 65 four-bedroom units of 1,367sqft. The showflats depict typical one-, three- and four-bedroom units, as well as two-bedroom + study apartments. "We try to introduce features on how to make use of space and full-height windows to create display areas or additional storage space," says Yong.

At Riversails, a first phase of 309 units will be released at an average of $827psf. This means that two-bedroom units will be from $677,000 ($796psf), while two-bedroom + study units will be from $741,000 ($811psf). Meanwhile, three-bedroom units will start from $879,000 ($793psf) and four-bedroom units, from about $1.15 million ($845psf), says Joseph Tan, executive director of residential at CBRE, joint marketing agents for the project with Knight Frank and DTZ. "More than 80% of the units in the development are priced attractively, at under $1 million," adds Tan.

In terms of unit sizes, two-bedroom units at Riversails are 893sqft - comparable with the compact three-bedroom units in some new suburban condos, says CBRE's Tan.

Riversails is expected to be completed in 2017. For the first two years after completion, the developer will provide free shuttle service to the Hougang MRT station. "The Upper Serangoon area is more accessible and closer to Hougang Central," notes Wendy Tang, director of residential services at Knight Frank.

There has been concern among buyers about oversupply in the mass market, given the number of government land sites being released. CBRE's Tan is confident that the mass market will be sustainable. "Every year, for the last three years, the number of new homes sold has either been equal to, or exceed the previous year's," he observes. "And this year is expected to be a bumper year, with some 18,000 to 20,000 new units sold for the full year, compared with about 16,000 in the previous two years. So, it's still sustainable. As long as interest rates are next to nothing, where else can you put your money?"

Source: THEEDGE SINGAPORE

Langganan:

Postingan (Atom)